These limitations suggest that risk matrices should be used with caution, and only with careful explanations of embedded judgments. Inputs to risk matrices (e.g., frequency and severity categorizations) and resulting outputs (i.e., risk ratings) require subjective interpretation, and different users may obtain opposite ratings of the same quantitative risks.

Categorizations of severity cannot be made objectively for uncertain consequences. Effective allocation of resources to risk-reducing countermeasures cannot be based on the categories provided by risk matrices. For risks with negatively correlated frequencies and severities, they can be "worse than useless," leading to worse-than-random decisions. Risk matrices can mistakenly assign higher qualitative ratings to quantitatively smaller risks. They can assign identical ratings to quantitatively very different risks ("range compression"). Typical risk matrices can correctly and unambiguously compare only a small fraction (e.g., less than 10%) of randomly selected pairs of hazards. In his article 'What's Wrong with Risk Matrices?', Tony Cox argues that risk matrices experience several problematic mathematical features making it harder to assess risks.

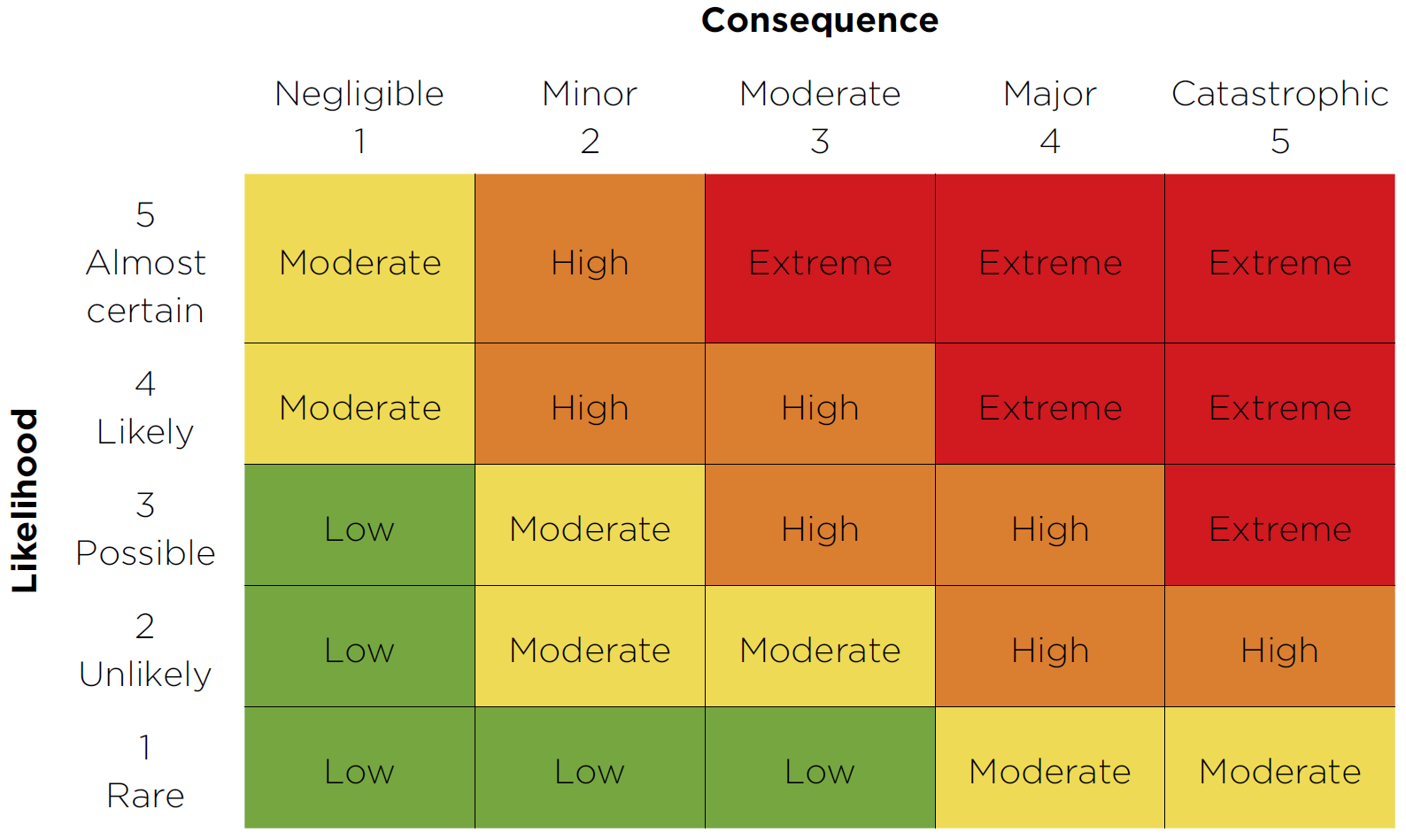

In 2019, the three most popular forms of the matrix were: Huihui Ni, An Chen and Ning Chen proposed some refinements of the approach in 2010. The risk matrix was in use by the acquisition reengineering team at the US Air Force Electronic Systems Center in 1995. Ī 5 x 4 version of the risk matrix was defined by the US Department of Defense on March 30 1984, in "MIL-STD-882B System Safety Program Requirements". The values on the risk axis were determined by first determining risk impact and risk probability values in a manner identical to completing a 7 x 7 version of the modern risk matrix. In August 1978, business textbook author David E Hussey defined an investment "risk matrix" with risk on one axis, and profitability on the other. It is said to have been an important step towards the development of the risk matrix. On January 30 1978, a new version of US Department of Defense Instruction 6055.1 ("Department of Defense Occupational Safety and Health Program") was released. For example, the likelihood of death in an aircraft crash is about 1:11 million but death by motor vehicle is 1:5000, but nobody usually survives a plane crash, so it is far more catastrophic. The risk matrix is approximate and can often be challenged. The following is an example matrix of possible personal injuries, with particular accidents allocated to appropriate cells within the matrix: This would be done by weighing the risk of an event occurring against the cost to implement safety and the benefit gained from it. The company or organization then would calculate what levels of risk they can take with different events. However it must be considered that very low probabilities may not be very reliable. The probability of harm occurring might be categorized as 'certain', 'likely', 'possible', 'unlikely' and 'rare'.

0 kommentar(er)

0 kommentar(er)